What is it about those entitled White guys who defy the norms of decent grooming to present themselves as “lovable rogues” and thereby somehow also defy the norms of truth-telling and probity to achieve outstanding success in their careers… all of it based on industrial-scale fraud and lies. And by doing this, they bring whole societies perilously close to the brink of economic collapse.

I’m not talking here principally about Donald Trump. (He fits the above description in many ways. But he is in a class of his own.) I’m talking about the two mop-haired fraudsters Boris Johnson and Sam Bankman-Fried. Johnson focused his career as a “foreign correspondent” on creating and retailing outrageous lies about the workings of the EU, which he then used to persuade the UK public to vote for Brexit. The economic hardships Britain’s people are now suffering can be overwhelmingly attributed to that disastrous decision. (But he was such a lovable rogue.)

And then there’s Sam Bankman-Fried, who energetically rode the cryptocurrency wave to astounding personal financial and political success. Still just 30 years old, this mop-haired fraudster has already achieved (a) a previous peak net worth of $26 billion, (b) the loss of most or all of that (largely notional?) wealth, and (c) the collapse of his company FTX, one of the largest of the “exchanges” on which cryptocurrency is/was traded.

Along the way Bankman-Fried– whose parents (1, 2) are both politically well-connected professors at Stanford Law School– and his sidekicks at FTX have been extremely generous donors to U.S. political campaigns. Open Secrets reports that in the almost-finished midterm election cycle, FTX’s people donated more than $70 million to congressional campaign bodies. The bulk of that went to Democratic organizations, though at least $20 million went to Republicans.

This well-reported piece by Tony Romm in today’s Washington Post gives a lot of detail about Bankman-Fried’s frequent presence on Capitol Hill in recent years. (B-F also visited the White House last May.) Right now he’s holed up, under some degree of control/surveillance, in the Bahamas, where FTX’s main entity was headquartered.

Meanwhile, an administrator appointed by the bankruptcy court in Delaware, where FTX’s US subsidiary is headquartered, has been starting to unravel the colossal mess left by the collapse of FTX. Romm reports that the administrator, who in 2002 supervised the unraveling of the $23-billion entity Enron, has described the collapse of FTX as “in some ways worse.” And a glance at the influential crypto newsletter Coindesk indicates that the collapse of FTX is causing continuing caving across the rest of the cryptocurrency sector…

So what, you may ask? People addicted to gambling can go to casinos anywhere and risk massive losses on the (very remote) chance that they might make massive gains. So why is cryptocurrency any more important to regulate (or ban) than other forms of gambling?

Three main reasons, I think:

- Cryptocurrency, by its very nature, has been designed as a way for dark actors around the globe to hide their financial transactions from both tax authorities and the police.

- Some regular (and regulated) U.S. banks have already launched some exploratory forays into the world of crypto. So what started in crypto would not necessarily stay in crypto.

- This, for me, is the clincher. “Creating” (or as its aficianados call it “mining”) cryptocurrency requires massive amounts of electricity, the generation of which of course involves huge amounts of CO2 emissions.

In May, Jeremy Hinsdale of Columbia Climate School reported that,

crypto has a dirty little secret that is very relevant to the real world: it uses a lot of energy. How much energy? Bitcoin, the world’s largest cryptocurrency, currently consumes an estimated 150 terawatt-hours of electricity annually — more than the entire country of Argentina, population 45 million. Producing that energy emits some 65 megatons of carbon dioxide into the atmosphere annually — comparable to the emissions of Greece — making crypto a significant contributor to global air pollution and climate change.

And crypto’s thirst for energy is growing as mining companies race to build larger facilities to cash in on the 21st century gold rush.

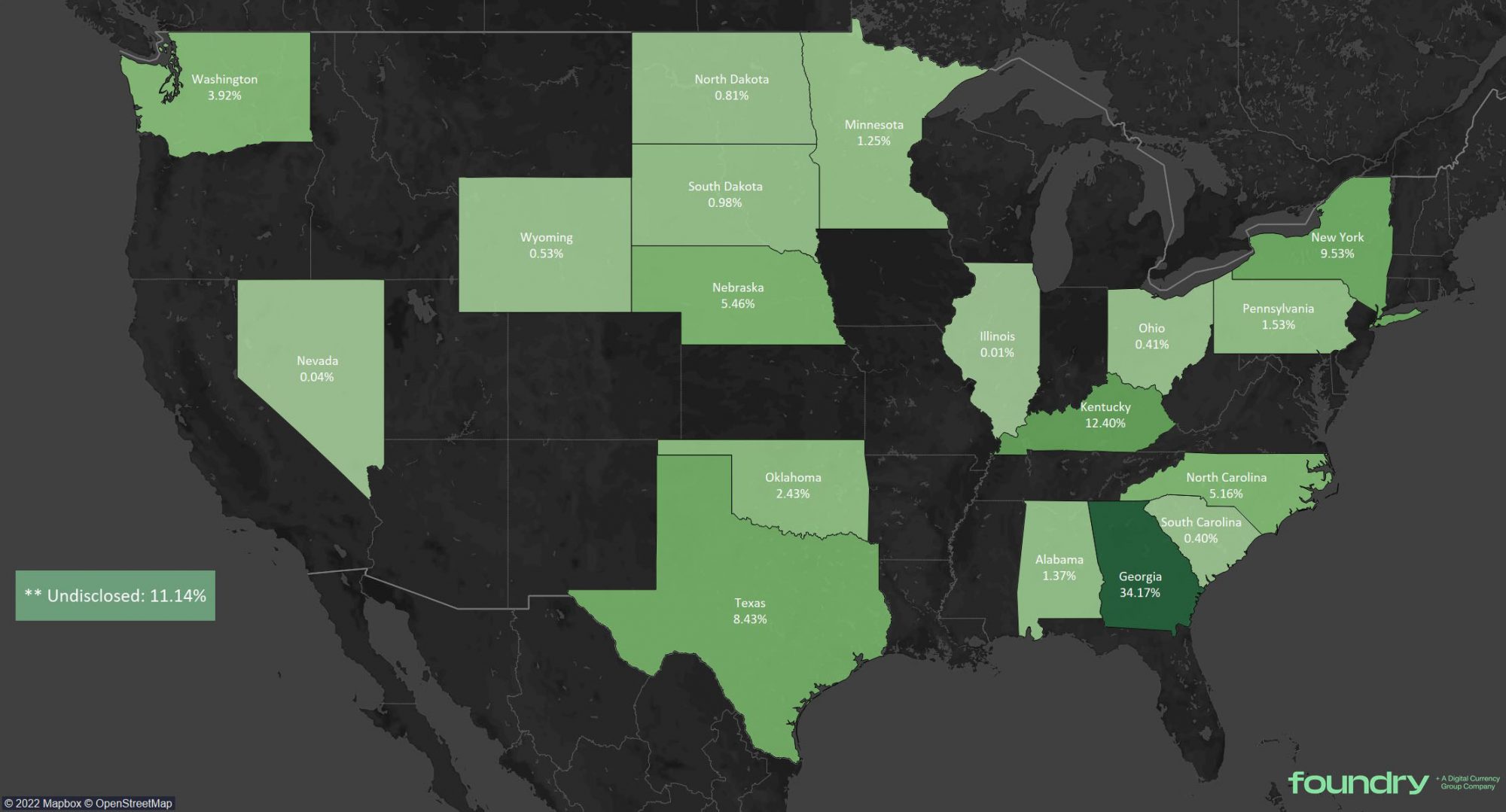

Hinsdale noted that until 2021, a lot of crypto “mining” was done using server farms in China. But the Chinese government cracked down on that. Today, he said, “the lion’s share of Bitcoin mining takes place in the United States, where 35% of Bitcoin’s hashrate — the total computational power used to mine and process transactions — is now located.”

Here’s the map he provides of where this happens. (Click on it to enlarge.)

Today, global leaders are working round the clock in Sharm el-Sheikh, Egypt, to figure how to curb global emissions enough to ensure that as much of life on earth as possible can be saved from climate disaster. Whole island nations are threatened with the annihilation of their national territory because of global warming. But this arrogant young mop-haired fraudster and his colleagues in the cryptocurrency “sector” have been allowed to continue spewing out their emissions all round the world, quite unchecked.

Tony Romm’s article in today’s WaPo gives a lot of details about the deliberations and machinations on Capitol Hill over the question of whether and how cryptocurrencies should be regulated. He tells us there is even a bi-partisan “Congressional Blockchain Caucus”, whose Republican co-chair Tom Emmer has argued in the past that the Securities and Exchange Commission “has misused its authorities to assert jurisdiction over cryptocurrency.”

Emmer is now on track to gain important new clout in the Republican-controlled House. On Wednesday, he told a blockchain “industry” lobbying group in Washington, that “We need to use the stage that is Congress to promote all of you beyond the walls of the Capitol… People need to understand more out there that they shouldn’t be afraid of this.”

The WaPo’s Romm notes that crypto supporters do not want the SEC to have any role in regulating crypto. They prefer to have the Commodity Futures Trading Commission (CFTC) be the regulator, seeing its potential oversight as less onerous. He notes that, “Lawmakers and administration officials have split over which regulator should have jurisdiction, partly a reflection of the complexity in defining crypto assets — whether they are commodities or securities — under law.”

I would argue that they are neither. They’re not “securities” and they most definitely are not “commodities.” You can’t eat or drink crypto assets. You can’t snuggle up in them when you’re cold. You can’t hang them on your wall to admire their esthetic qualities. You can’t house the homeless with them. They are simply the tokens of inveterate and greedy gamblers.

Throughout the history of finance capitalism, there have been many commodity bubbles. The first of those was the tulip frenzy that struck the financial innovation incubator of Holland back in the mid-1630s. But at least, when that bubble burst some investors ended up with some beautiful tulip plants. (And the Netherlands ended up with a massive, world-dominating tulip cultivation industry.)

In the case of the crypto frenzy, the many (somewhat gullible) smaller players who will end up, as always, losing all their crypto “assets” in this collapse will end up with… precisely nothing in hand.

Because there is nothing there.

But meanwhile, all that electricity will have been generated and all those ghastly CO2 emissions will have been emitted… All for nothing. And the blockchain-derived emissions already spewed out over recent years– at a rate comparable to those of Greece!– will be hanging in the air forever.

We could spend time imagining what constructive uses that electricity could have been put to. (In the U.S. State of Georgia, where more than a third of all the U.S. blockchain “mining” occurred, that electricity could have been delivered free of cost to power useful industries, homes, schools, or hospitals… )

Or, we could start to put pressure on governments all around the world to close down the globe-girdling crypto casino once and for all. I vote for that way forward.