(This is Part 3 in my series “Covid chronicles.” Click here for the earlier parts. Also: The image above is from a video released yesterday by the Chinese TV network CGTN. I’m displaying it not because I approve of its racist depiction of Americans as babies but because it’s an interesting– probably not very effective– example of Chinese public diplomacy in the English-speaking world right now.)

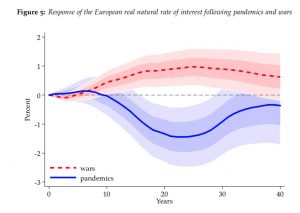

I have a neighbor and friend who was an early victim of Covid-19. She did not die, thank God, but (like many other survivors) she has continued to be pole-axed by the sickness for nearly two months. The recovery of nations from the effects of the disease will be considerably more long-drawn-out, and complex.  In March, the San Francisco Fed produced a report (PDF here) assessing the longterm economic impact of 15 large pandemic events since the Black Death of 1347-52. It found that the depressing effect these pandemics had on the economies that suffered them lasted for 40 years afterwards–the blue/lilac curve here. (For what it’s worth, wars left a generally positive economic effect from about Y+5 onwards– the pink/red curve.)

In March, the San Francisco Fed produced a report (PDF here) assessing the longterm economic impact of 15 large pandemic events since the Black Death of 1347-52. It found that the depressing effect these pandemics had on the economies that suffered them lasted for 40 years afterwards–the blue/lilac curve here. (For what it’s worth, wars left a generally positive economic effect from about Y+5 onwards– the pink/red curve.)

Clearly, though, the countries now afflicted with Covid-19 will “recover” at different rates, in different ways, and to differing extents.

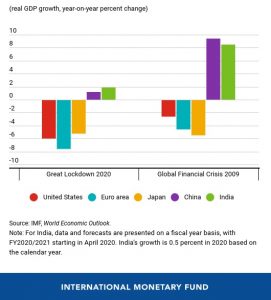

On April 14, Gita Gopinath, the super-smart Director of the IMF’s Research Department, issued a sobering edition of the IMF’s World Economic Outlook series predicting that global GDP would shrink in 2020 to 3% below what it was in 2019. This was a dramatic revision to the WEO she released just in January, in which she forecast that world GDP would increase by 6.3% in 2020.

But the contraction Gopinath forecast in April was not evenly spread. In this chart in her blog post, she shows us– in the left half of the image– that she expected the United States’ GDP to shrink by 5.9% in 2020, while China’s would grow by 1.2%. (The precise numbers for these forecasts are here.)

But the contraction Gopinath forecast in April was not evenly spread. In this chart in her blog post, she shows us– in the left half of the image– that she expected the United States’ GDP to shrink by 5.9% in 2020, while China’s would grow by 1.2%. (The precise numbers for these forecasts are here.)

All of us who are living in the United States today are experiencing the near-seize-up of the country’s economy in a very direct way. I walk and drive by shuttered shops and small businesses and by alarmingly large homeless encampments– here in the “capital of the free world”. I have a son-in-law who built, runs, and co-owns two once-bustling restaurant/bars in New York City, the fruit of 15 years of hard work. Now, at just one of them, he’s trying to pull in a little income by doing takeout. But no-one can describe this as a business plan. The “relief” money that the President and Congress have been doling out is miniscule compared to most people’s needs, and very short-term. Meantime, the cockamamie, crony-ridden, and criminally corrupt way the federal government has been responding to the medical aspects of the crisis has ensured that it will continue for several months more, bouncing around the country from place to place. It is quite possible that the next time Dr. Gopinath releases a WEO projection, the outlook for the U.S. economy for 2020 may even worse than it was in mid-April.

* * *

There are three key factors that will determine the effectiveness of any country’s ability to bounce back, economically, from the effects of Covid-19 (or of any of the other Covids that may come in its wake…) They are:

- The effectiveness of the medical and public-health measures that are taken.

- The nature of the government’s economic intervention. (I was considering breaking this out into two sub-categories: the size and the direction of any such intervention. But a wrongheaded, financier-coddling intervention would be damaging whatever its size… More on this, below.)

- The ability of the government to maintain public support for its actions regarding #1 and #2 above.

As I blogged here, May 6, the US government’s response to the medical/public-health challenge has been astoundingly poor. A recorded death rate as of then, of 21.78 per 100,000 of population, within just over two months from the first death, is appalling in such a rich country. (Many Covid-19 deaths may not have been recorded as such.) And in the United States, the death toll continues to mount.

In China, by contrast, the death rate was 0.33 per 100,000 and the pandemic was apparently halted in its tracks back in March. This was the result of public health measures judged by many outsiders at the time to be draconian. They included the speedy development, distribution, and, deployment of a test for the virus; a complete lockdown of the sizeable city of Wuhan; widespread restrictions throughout the whole of the rest of the country and especially at its borders; and the mobilization of numerous different layers of cadres for both medical and social-service tasks.

This past week, many school students in Wuhan returned to their desks; and CBS was even reporting that Shanghai Disneyland is due to reopen next week.

When governments have been responding to the sharp contraction of economic activity that the various quarantine and lockdown measures have caused, they have made choices between, basically, two different approaches. One ends up giving nearly all the benefits to financial institutions. And this, as NYC-based economist Michael Hudson explained here, can be done in many indirect ways– not just by organizing the whole chaotic “small business support” handout to be directed through the banks, which Trump also did.

The other, fundamentally different approach would be a repeat of what FDR did during the 1930s, in his response to the Great Depression. In his “New Deal” program, it was the federal government that ran nearly all the programs, which had a strong focus on infrastructure upgrades. The federal government did nearly all of the employing in these programs, directly. The role of banks and speculators was minimal.

Yes, the New Deal involved setting up lots of completely new programs from scratch, which took time. Yes, it involved a great increase of the role of the federal government in not just the economy but also American society more broadly… And it worked.

Guess who’s implementing FDR-style policies this time round? No, it is not Donald Trump. It is Chinese President Xi Jinping. According to this recent article by Eva Dou in the Washington Post, in 2010 the Chinese leaders commissioned economist Liu He (now, the Vice Premier) to study how the country’s response to the 2008-09 financial crisis had gone. Liu also, it seems, included a study of FDR’s New Deal in the report his team published three years later.

Dou writes,

China’s response this year shows that it has taken some lessons from the financial crisis. Beijing flooded the country with cash and cheap credit in 2008, which kept its economy growing but resulted in years of teetering local government debt and skyrocketing housing prices, said Citibank’s chief China economist, Li-gang Liu…

This time, China has announced that it will see the crisis through with infrastructure construction, a more stable if slower method of economic stimulus. Xi recently warned that houses were for living, not for speculation.

(Several other aspects of Liu’s report, as described by Dou, are also intriguing.)

* * *

What size of economies are we talking about, in the United States and China? In 2019, the United States’ GDP was counted at $21.2 trillion, and China’s at $14.2 trillion in current US $– and for a population that was four times as big. If, over the next two or three years, China’s economy can show some continued growth while the U.S. economy continues to contract– which is quite possible– then by 2022 or 2023 the economies of the two countries may be of roughly equal size.

Economic capability confers power within the international system in a number of ways. A country (or a group of countries like the EU) that has a robust economy has assets that other countries may need or crave, that it can use as leverage. These would include:

- Its products, if fit-for-task and well-priced

- Its technology

- Its investment capital and other financial instruments

- Access to its market

- Access to its financial instruments.

Over the 75 years since the end of World War II, the United States has used all these levers of economic power. Japan and the EU (and some EU member nations like Germany or Britain) have used some or all of them. In the past 20 years, China has increasingly been able to use– and has used– all them, too.

Raw economic performance in terms of GDP does not, of course, translate directly into power within the global system. Other factors that also confer power in the global system include: the robustness of the trade and other kinds of relationships the country enjoys with other countries; having (and demonstrating) an ability to defend one’s country from external threats or internal decay; having attributes that citizens of other countries admire– these include but are not limited to a reputation for generosity and fairmindedness; having veto power in the Security Council and a strong position in other international organizations. I will consider some of these in later blog posts in this series.

* * *

I have been watching China’s gradual rise in the world’s GDP– as well as GDP-per-capita– charts and a concomitant fall in the United States’ position in these charts, for nearly 20 years now. The United States’ decline is still relative rather than absolute. In absolute terms, its GDP is still “Number 1!” But the decline was accelerated from 2003 on, when successive US presidents decided to pour massive amounts of government revenues into large-scale and always disastrous military adventures all around the world. As of last November, Brown University’s “Costs of War” project tallied the U.S. budgetary costs of these wars, FY2001-2020, to be $6.4 trillion. These were funds that could have been invested, instead, in repair and upgrading of vital infrastructure here at home– including vital health infrastructure. But no. Instead, the money was shoveled into the pockets of the large military contractors who then used a portion of it on expensive lobbying operations designed to ensure that the sow of military spending continued feeding her offspring (them.)

When Donald Trump became president, in 2017, one of his early instincts was to pull back from the foreign wars. (This was about his only sound instinct.) The military-industrial complex then proved able to slow-walk a lot of the military-retraction moves he wanted to make… One of the other abiding themes of Trump’s presidency has been his desire to “decouple” the U.S. economy from the tight integration it had developed at many levels with the economy of China, as part of broader push to halt or slow the rise of China’s power in the global system. At the economic level, we have seen the “tariff wars” and the campaign against Huawei. At the military level, we have seen a slight escalation in the kinds of “demonstration operations” the U.S. Navy has been mounting in the South China Sea. Mobilizing against “Chinese influence” also seems to come naturally to a president who shows no hesitation in denigrating anyone– even US citizens and politicians– who happens not to be of pale-complected European-style hue.

With the eruption of Covid-19 in U.S. communities nationwide, Pres. Trump’s pre-existing proclivity to demonize and denigrate anything Chinese has escalated considerably– spurred on, it seems, by his evident desire to find an external scapegoat to blame for the terrible situation Covid-19 has inflicted on Americans and to detract voters’ attention from the grave responsibility he and his administration bear for their plight.

He and his economic advisors clearly realize that, with the supply chains of major US industries still inextricably tied up with companies located in China and with China still holding $1.1 trillion-worth of U.S. government debt, he can’t just cut the cord and decouple from China overnight. Yesterday, his Treasury Secretary and the US Trade Representative held a phone call with China’s Vice Premier Liu He, the intent of which was to reassure both sides that a trade deal concluded four months ago would still be adhered to.

But today, less than 12 hours after the reassuring joint statement released after the phone call, Trump told Fox News that he was “very torn” about the trade deal, and had “not decided” whether to maintain it. This, as he launches frequent verbal tirades against China for having “caused” the coronavirus crisis.

* * *

The public-health and economic data I’ve been looking at in my last blog post and this one all strongly indicate that the balance of economic power between Washington and Beijing has started shifting very rapidly. And given the United States’ inability/unwillingness to take the public-health steps necessary to stop or even halt the spread of Covid-19, this balance will be shifting in China’s favor even more rapidly over the coming year.

All of us on this planet are moving into a post-coronavirus world, which will be one in which the strength of a country’s public-health infrastructure will necessarily constitute, and be seen as, a major component of a nation’s power. Countries that do not have a strong public-health infrastructure will not only see their power in world affairs declining speedily, they will also increasingly find themselves being excluded from normal intercourse (personal visits, trade, etc) by the countries that do.

There will almost certainly be a big decoupling– but it will not look anything like the one that the anti-China ideologues in Washington have been pushing for. The prospects for most Americans look very grim.